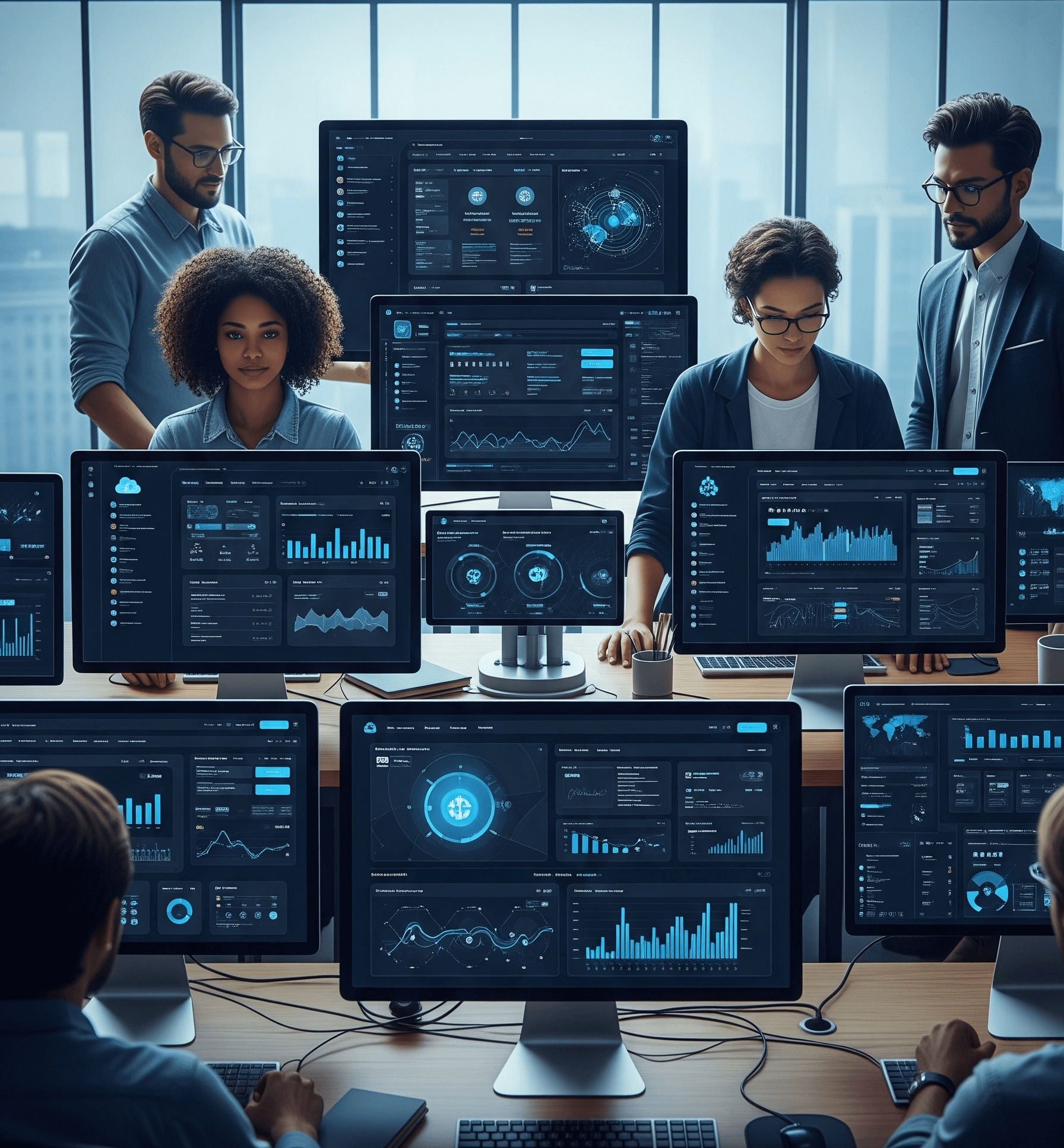

Step into the future of finance with custom-built FinTech software that’s fast, secure, and tailored to your business needs. At StageBit, we develop cutting-edge digital solutions that drive innovation, simplify complex financial processes, and deliver seamless user experiences. Whether you're a bank, startup, or payment provider—our scalable tech empowers you to stay ahead in the evolving financial landscape.

Create intuitive and secure digital banking experiences with custom-built apps and portals that enable customers to manage accounts, perform transactions, and access support effortlessly.

Deliver smooth and secure payment experiences with high-performance gateways that support global transactions and diverse payment options.

Empower financial institutions with software that simplifies loan processing, credit evaluation, and repayment automation.

Enable transparent, decentralized, and secure financial ecosystems using blockchain-based platforms and digital asset innovations.

Unlock powerful insights from financial data through advanced reporting tools, predictive models, and real-time visualizations.

Automate risk and compliance processes with smart RegTech solutions designed to keep you ahead of regulatory demands.

Revolutionize financial planning with AI-driven assistants that offer personalized insights, budgeting support, and investment guidance.

Unlock the future of finance through cutting-edge technology that enhances security, simplifies transactions, and empowers smarter decision-making.

StageBit empowers financial organizations to lead with technology through secure, scalable FinTech solutions. From digital banking and payments to compliance automation and wealth platforms, we deliver future-ready software that drives innovation, trust, and growth in a digital-first economy.

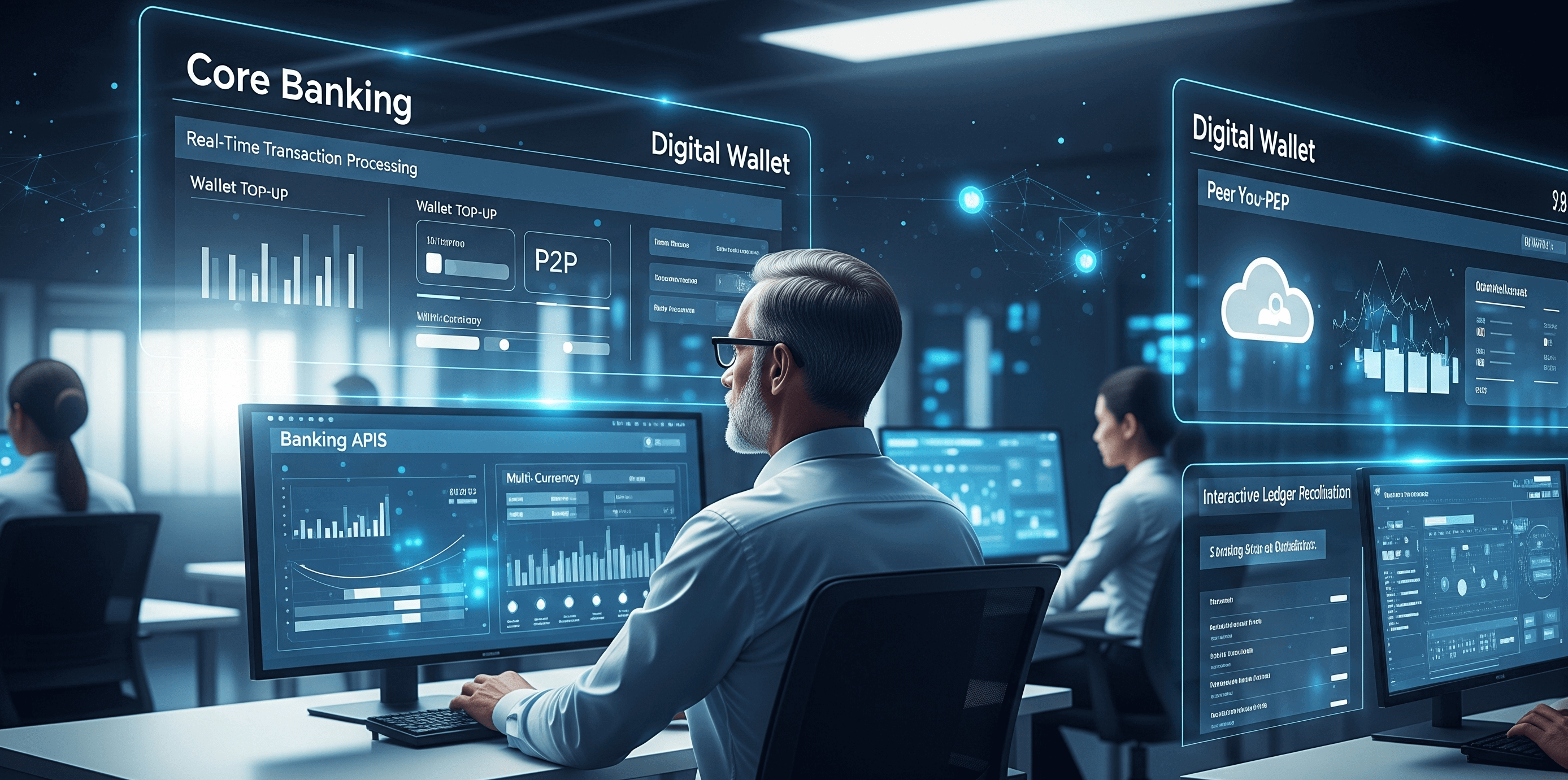

Facilitate seamless and secure transactions with modern payment gateways and wallet systems tailored for global finance operations.

Launch modern, mobile-first digital banks with features like automated KYC, instant account setup, and 24/7 banking access.

Empower users with smart investment tools powered by AI-driven advisory models and personalized financial strategies.

Stay ahead of financial regulations with intelligent systems that automate compliance, detect fraud, and generate audit-ready reports.

Accelerate the loan process with advanced credit scoring algorithms, seamless applications, and repayment management tools.

Integrate blockchain to ensure tamper-proof transactions, digital asset security, and automated contract execution at scale.

Transform financial data into growth strategies using predictive analytics, intelligent dashboards, and cross-channel insights.

Build a connected financial ecosystem with secure and standards-compliant APIs enabling collaboration with third-party fintechs.

Strengthen customer security with robust identity solutions including biometric logins, adaptive access, and identity lifecycle management.

At StageBit, we engineer future-ready FinTech solutions that redefine how financial services are delivered and experienced. By blending advanced technologies with intuitive design, we help banks, startups, and financial institutions accelerate innovation, boost customer trust, and thrive in an increasingly digital financial landscape.

Create seamless digital banking journeys with features like real-time transactions, personal finance dashboards, and biometric logins for enhanced user security and convenience.

Speed up loan approvals with AI-driven eligibility checks, automated document validation, and integrated e-signature workflows for a fully digital experience.

Empower users with intelligent investment recommendations based on data-driven insights, helping them make informed decisions aligned with their goals and risk profiles.

Enhance transaction integrity and cross-border payment security with blockchain technology that ensures transparency, immutability, and trust in financial records.

Reduce compliance overhead by automating regulatory tasks such as AML screening, transaction monitoring, and audit reporting using smart data tools.

Seamlessly integrate financial services like payments, insurance, or credit into your digital products using powerful API-based embedded finance technologies.

At StageBit, we empower financial institutions to lead in a rapidly evolving digital world. Our FinTech solutions are designed to modernize legacy systems, enhance operational efficiency, and deliver seamless, customer-centric experiences across digital platforms.

Whether you’re a challenger bank, lending startup, or investment firm, we build scalable and secure software tailored to your goals—ensuring compliance, performance, and innovation at every step.

From startups to big enterprises, development

From startups to big enterprises, development

From startups to big enterprises, development

From startups to big enterprises, development

From startups to big enterprises, development

From startups to big enterprises, development

From startups to big enterprises, development

StageBit delivers agile, intelligent financial software that reimagines how people and businesses interact with money — from frictionless onboarding to real-time analytics and secure digital ecosystems.

Fuel innovation in finance with tailored FinTech development services from StageBit. We build scalable, secure, and future-ready digital solutions that help startups, banks, and financial institutions stay ahead in a rapidly evolving industry.

Transform traditional banking systems with next-gen core banking engines and user-friendly digital wallet solutions tailored for a cashless future.

Empower individuals and businesses with secure and efficient P2P lending systems that ensure full transparency and regulatory adherence.

Streamline your regulatory processes with automated tools that ensure compliance, reduce risk, and enhance operational transparency.

Deliver personalized investment strategies with AI-driven advisory tools that simplify portfolio management and drive smarter wealth decisions.

Integrate fast and secure payment gateways that support local and global transactions while maintaining compliance and fraud protection.

Unlock secure and transparent financial operations with blockchain and smart contracts designed for scalability, compliance, and automation.

Streamline compliance and build customer trust with intelligent KYC and AML solutions built for real-time verification and risk mitigation.

Transform traditional insurance operations with modern, automated platforms that elevate user experience and operational agility.

Empower smarter financial strategies with advanced analytics tools that reveal insights, optimize performance, and forecast trends.

Safeguard your fintech platform with intelligent security systems built to detect threats, prevent fraud, and ensure regulatory compliance.

Here are some frequently asked questions about our FinTech software development services:

Ans. FinTech software development involves designing secure, scalable, and innovative digital solutions for the finance sector. It covers everything from mobile banking apps to blockchain integration—empowering financial institutions and startups to streamline operations, enhance user experience, and meet regulatory standards efficiently.

Ans. We follow a compliance-first approach by embedding financial regulations such as KYC, AML, PCI-DSS, and GDPR directly into the software architecture. Our team collaborates with legal advisors and regularly audits systems to keep your product aligned with evolving regional and international laws.

Ans. At StageBit, we develop custom FinTech solutions including mobile banking apps, investment management tools, lending platforms, cryptocurrency wallets, digital payment gateways, and financial dashboards. Whether you're a startup or an enterprise, we build tools tailored to your goals and audience.

Ans. Security is baked into every layer of our FinTech development process. We implement end-to-end encryption, multi-factor authentication, biometric logins, and continuous penetration testing. Our secure coding practices comply with OWASP and ISO standards to protect sensitive financial data.

Ans. Yes, our FinTech platforms provide real-time data processing and analytics capabilities. From live transaction tracking to AI-driven insights and predictive analytics, we help businesses make informed decisions faster with dynamic dashboards and reporting tools.

Ans. Absolutely. We offer seamless integration with leading third-party financial services such as Stripe, PayPal, Plaid, QuickBooks, and Open Banking APIs. Our developers ensure these integrations are smooth, secure, and enhance your platform's performance and user experience.

At StageBit, we believe strong client relationships are built on results, reliability, and transparency. Whether it's launching a new digital platform or streamlining an existing system, we work closely with every client to understand their goals and deliver solutions that truly make a difference.

We’ll get back to you within 8 business hours — guaranteed.

Provide us with some basic information to help us understand your requirements..

Get personalized recommendations, project estimates, and strategic insights.

An Account Manager from our team will connect with you shortly to discuss your needs in detail.